2023 Payments Insights: Payments and Fintech Strategies in an Economic Downturn - QikServe

Stripe, the global financial infrastructure firm powering QikServe Payments, surveyed more than 2,500 payments, finance and product leaders around the world about how they’re planning to increase revenue and reduce costs in 2023.

The statistical report includes survey data from global brands, insights from industry leaders and best practices for implementing growth strategies. Companies around the globe have felt the impact of the current economic climate and its setbacks. Despite the economic downturn, business leaders are finding ways to drive growth and reduce costs by:

- Localizing the checkout experience to maximize revenue

- Embedding financial services to boost revenue and customer loyalty

- Automating financial tasks so engineers and finance teams can focus on strategic work

- Consolidating software programs to centralize data, cut costs and save employee time

Key Research Findings:

- 82% of companies that plan to expand into new countries will localize their checkout experience.

- 75% of all global companies – regardless of business model – will embed financial services directly into their product.

- 70% of companies plan to consolidate software providers, particularly B2B payments and invoicing.

- 60% of finance leaders agree that over the past three years, their teams have spent more time on operational work and less on strategic work.

“QikServe began its life in the aftermath of the 2008 crash. Innovating to build resilience is in our DNA. The global restaurant and hospitality brands with whom we work are riding this current storm across the industry by looking for new ways to create opportunities to optimize and maximize their businesses.” – Dan Rodgers, Founder, QikServe

QikServe Recommends:

Localizing – Offering multi-language, multi-currency ordering for your customers is an effective way to remove barriers in ordering while maintaining consistent brand messaging across multiple geographical sites. QikServe Payments provides global support for payments across all major card brands and wallets, with global payments coverage to suit your business needs, no matter where your sites are located.

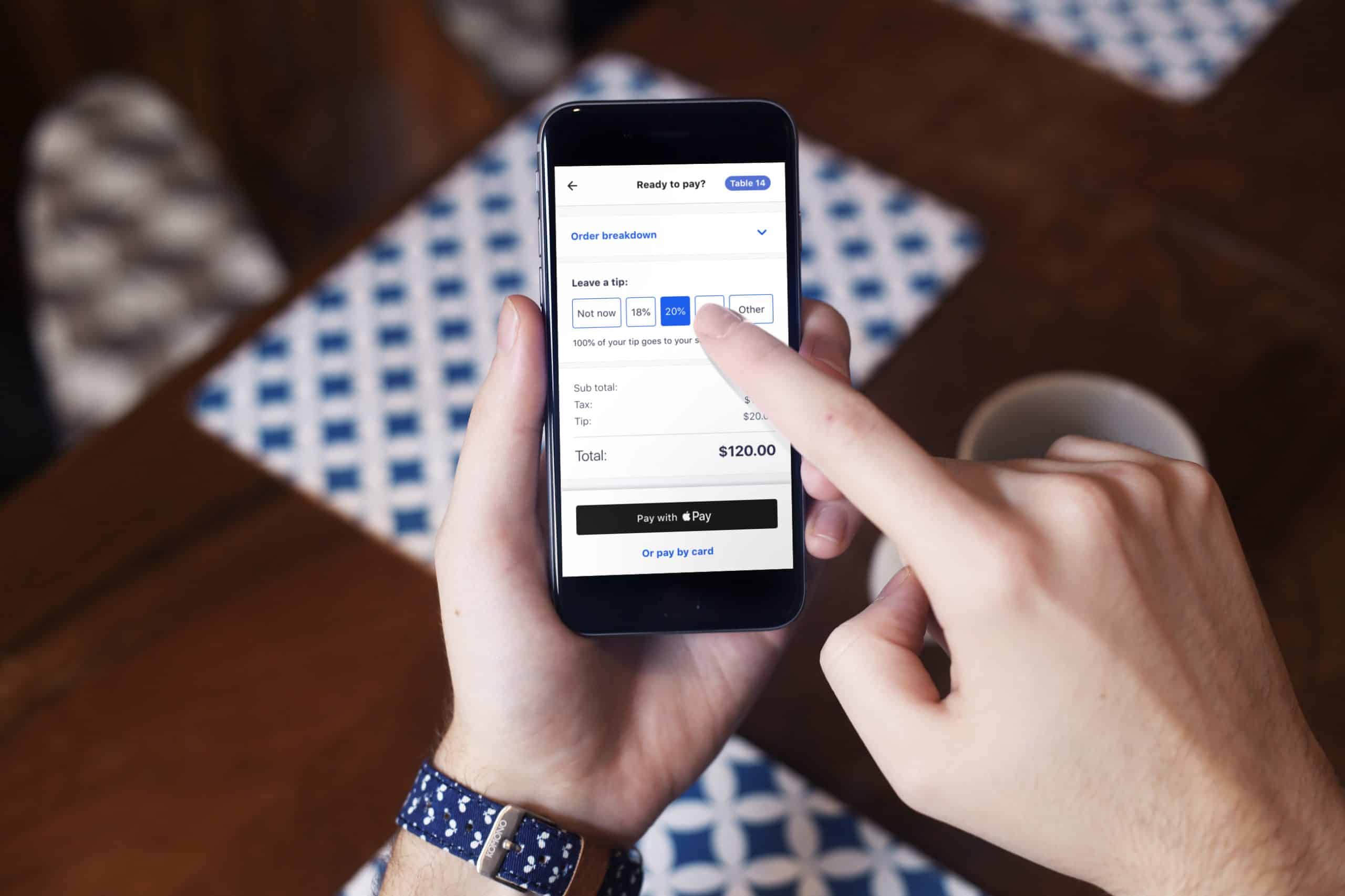

Embedding financial services – Integrating secure and convenient payment options through QikServe Payments, can encourage customers to complete transactions, leading to increased sales. Additionally, QikServe’s integrations with loyalty programs and rewards tied to QikServe Payments can enhance customer experience and foster repeat business.

Automating financial tasks – By implementing the automated systems and processes offered by QikServe Payments, businesses can streamline financial operations, such as payment processing (where daily payments are standard, not an exception) and reporting. This will not only save time but also allow your finance teams to focus on more strategic initiatives that contribute to business growth.

Consolidating software programs – By centralizing data and using integrated software solutions, hospitality and restaurant businesses can cut costs and save employee time spent on managing multiple systems. Streamlining software programs leads to better data insights and more efficient operations. QikServe Payments offers one consolidated payment reporting dashboard for powerful transaction and payout reporting.

Reach out to us to learn more.