Enhancing revenue through effective fraud prevention

What is it that unites digital commerce across size, industry, business model and geography? The answer, unfortunately, is fraud.

Whether you’re running a luxury hotel in Latin America or a fast-food restaurant in Europe, your fraud risk – and potential for revenue loss – has likely grown noticeably over the past two years. And it’s only getting worse. If you’re like most business owners, you’re finding it more challenging to strike the right balance between cutting back on fraudulent transactions without hurting legitimate business through digital journeys and reducing losses without increasing operational overhead.

QikServe Payments partner, Stripe, recently published an in-depth report on the state of online fraud around the world. Stripe surveyed 2,500 business leaders in nine countries and analyzed data from billions of attempted payments across millions of businesses on Stripe over a two-year period.

The findings were illuminating. Among them:

- 64% of global business leaders say it’s become harder for their business to fight fraud since the start of the pandemic.

- Early in the pandemic, Stripe observed a 156% increase in product-related disputes.

- 40% more businesses experienced attempted card testing attacks.

- Fraud increased everywhere, but the rates varied widely by region and country.

What accounts for the dramatic increase in fraud? Quite simply, the historic wave of digital commerce growth since 2020 opened up a wealth of opportunity to fraudulent actors.

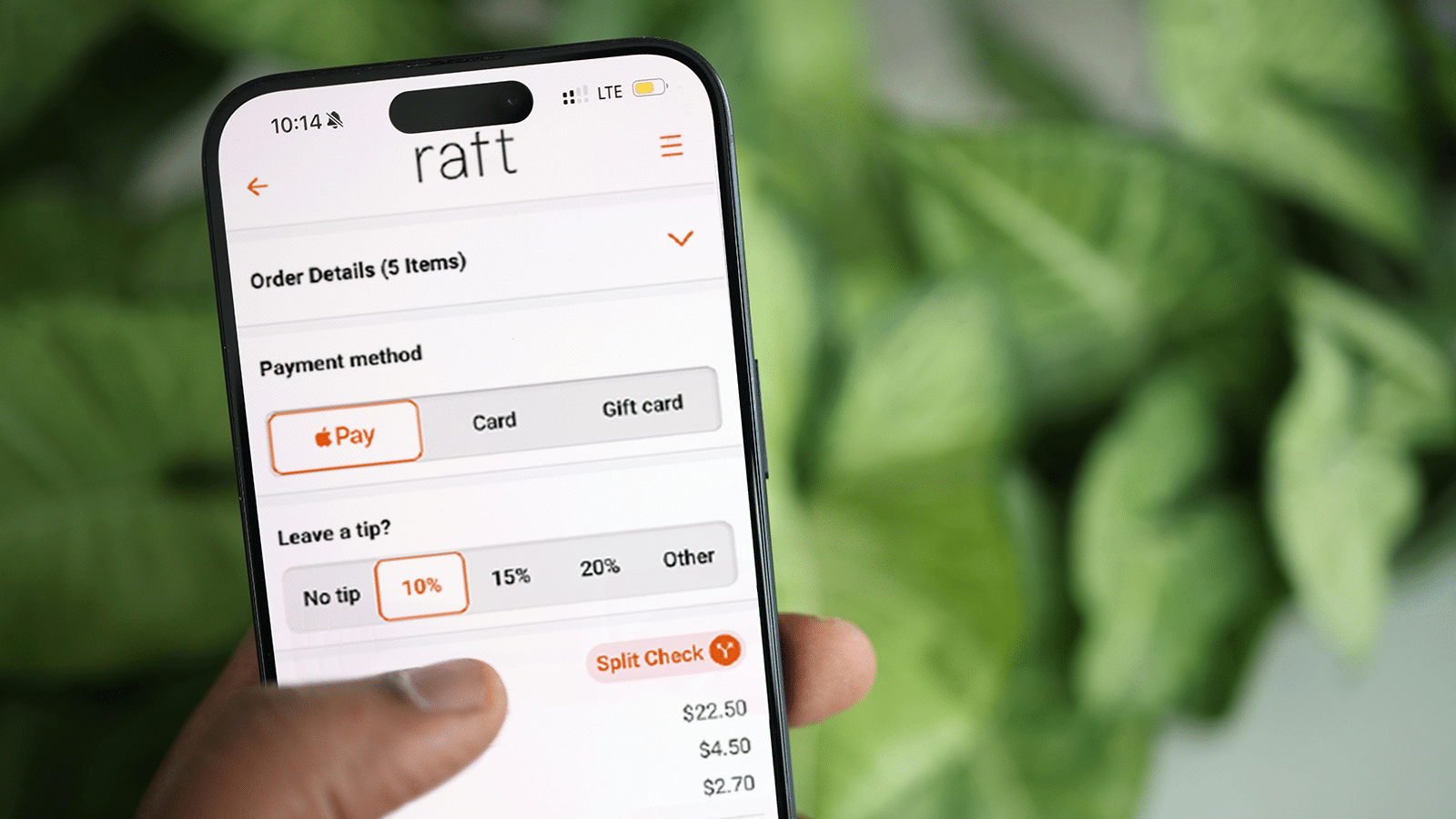

Hospitality businesses offering digital journeys grew in record numbers, increasing revenues through online ordering for delivery, order ahead for collection, and QR code order and pay at table.

To give you a sense of the scale of growth, processing volumes powered by QikServe Payments grew by 856% in 2022 alone, with QikServe’s digital commerce platform now processing over $600 million orders for hospitality businesses per annum.

While at first glance the situation with fraud may seem overwhelming, QikServe Payments now observes a fraud rate of just 0.01% with fraud protection ‘Radar’, powered by Stripe.

Following the introduction in October 2022 of QikServe Payments Fraud Protection, powered by Radar for Fraud Teams, QikServe witnessed an immediate reduction in fraud, with the platform continuing to experience fraud rates that are close to zero.

The Stripe solution allows QikServe Payments to select a risk tolerance that aligns with its business model and that of its hospitality customers. Using historical transaction data, QikServe Payments can experiment with modelling to see how different rule changes help to increase authorization rates.

Based on its experience and predictions for the evolution of fraud, QikServe Payments has identified four key ways in which you can adapt and stay a step ahead of the fraudulent actors:

1) Lean into hospitality fraud interventions

Interventions are becoming an increasingly popular way to avert fraudulent actors without sacrificing customer experience. QikServe Payments’ partner Stripe analyzed the 3DS intervention in particular and found that adoption increased across the board in 2021. 3D Secure is an especially important intervention for companies doing business in Europe, as it’s the main card authentication used to meet the European Strong Customer Authentication (SCA) requirements.

Consider employing a mix of interventions, and tailor them to your hospitality business needs. Remember, there’s no one-size-fits-all approach: The key to successful fraud mitigation is to select the right intervention, the right intervention trigger and the right placement in the guest ordering journey based on your organization’s margins and unique risk tolerance.

Many hospitality businesses are already collecting data from across the guest ordering journey that can give a holistic view of a customer’s risk – including behavioral data, social networking data, biometrics and enriched third-party data, among other things – but the tools and technology used to gather each of these data points are often in siloed, disparate systems.

It may be a good time to invest in new technologies, such as QikServe Insights, to unlock and consolidate your customer data (in a compliant way), enabling your organization to reach a greater degree of accuracy in detecting and fending off fraud.

3) Collaborate with QikServe Payments

Fraud isn’t a battle you should fight alone. Combating a problem as large and ever shifting as fraud necessitates collaboration and a sharing of resources across entities. In this case, information is a key defense and QikServe Payments is here to support the process.

When your customer completes their digital ordering journey – whether ordering online or via QR code order and pay at table – your payments provider sends the details to the customer’s bank (the card issuer) for authentication. Based on limited information received, the issuer then calculates the fraud risk of the transaction.

It should come as no surprise that limited information can lead to lower authorization rates, but the scale is indeed stunning: False declines in 2021 resulted in lost revenue to the tune of USD 443 billion. But, as we mentioned above, most hospitality businesses like yours already have relevant customer data that can better inform the fraud risk calculation. Even the simplest of data points such as email or billing addresses can help.

Combining this data with the issuer’s data can yield more accurate predictions, thereby increasing authorization rates and decreasing fraud rates in the process.

4) Head off fraud earlier in the digital ordering journey

QikServe Payments ensures some default measures that can help you prevent fraudulent activity right from the start of the ordering journey.

Confirm a customer’s identity during the check-out process to include:

- Postcode

- Email address

- CVC check

Get in touch here to learn more about how QikServe Payments can help you to significantly reduce your fraud rates whilst offering a revenue enhancing, comprehensive, reliable, and robust payment platform, which is specifically designed for the hospitality industry.