Payments Rooted in Technology - QikServe

As an adaptive business, here’s how you can use payments as a growth tool…

In our increasingly digitised world, seamless and efficient payment processing for digital transactions has become a priority across industries. Traditional payment processing systems no longer suffice as hospitality operators require a comprehensive payment platform to streamline their tech stack, drive sales and unify siloed data. Implementing a new system may seem daunting as budgets are tight and labour is strained, but innovation is the key to remaining competitive and it has never been more vital to provide a quick and painless way to pay.

As an adaptive brand with the foresight to anticipate change and the flexibility to adjust to it, you can stay ahead of the game and drive success. Having an adaptive mindset is a huge competitive advantage and has never been more necessary than it is in these times of ever-changing markets and behaviours.

Customers’ habits, needs and expectations are constantly changing, and it can be arduous to keep up, but you must have the flexibility to act quickly to the changing landscape. When you can adapt to changing preferences, you can safeguard your business as you better withstand radical disruption and even grow in the face of it.

So, how can you adopt an adaptive mindset? Let’s explore what it means to be adaptive, how a payment strategy that’s rooted in technology can drive your adaptive approach, and how QikServe Payments (QP) can support you, help you expand your customer base, and grow your revenue to thrive through disruption.

Three Traits of an Adaptive Business

Being adaptive is a state of mind which embraces and drives change, taking a proactive rather than reactive approach to your business strategy. Recognise that payments are not just a transaction, but a crucial part of your product that profoundly shapes your customer’s experience and brand perception. Your payment process should be rooted in flexible technology that can serve all your money needs – from optimising your authorisation rates, to safeguarding your business from fraud, to adding new business models or expanding globally, having the right payment system in place is the key to being truly adaptive.

1. Stay Ahead as Technology Moves Forward

You’ll find it easier be flexible and meet demands once you are invested in the right technology and infrastructure as you’ll be able to anticipate your customer’s needs ahead of time with the flexibility to react with a well laid plan.

Ready When You Are

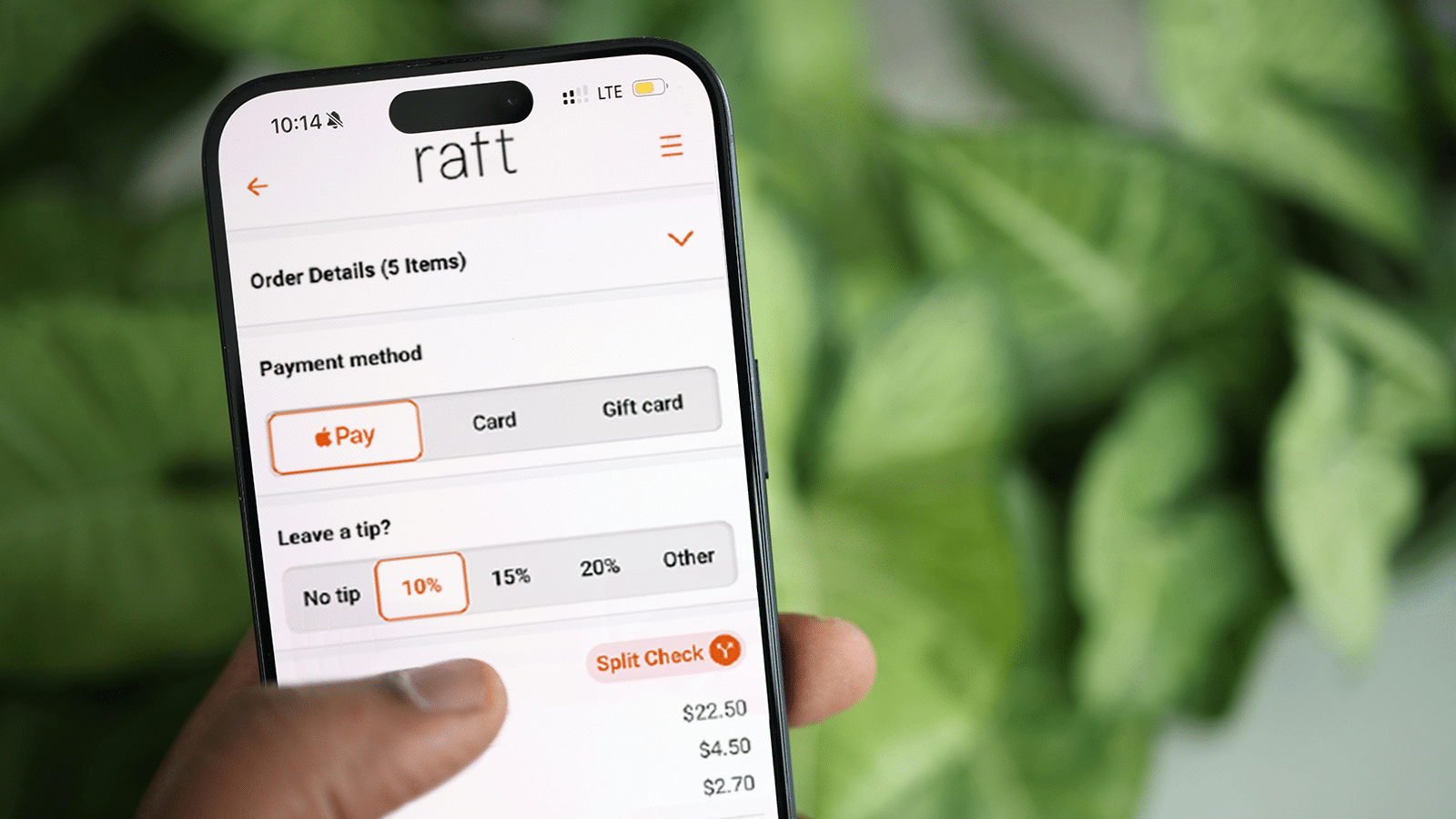

A key to moving quickly is being ready to accept payments of (almost) any kind, anytime, and anywhere. The slow-moving and rigid legacy payment systems of the past don’t allow for the nimbleness needed to adapt in a fast-moving market.

With QP and Stripe, the infrastructure is already in place to support your next move. As a comprehensive, reliable and robust payment platform designed specifically for the hospitality industry, you benefit from everything you may need to drive sales with fraud protection, simplified payments, comprehensive reporting, transparent pricing, speedy onboarding, and the capacity to process multiple payment options including Google Pay, Apple Pay, Visa, Mastercard and American Express. You will benefit from the ability to report directly from QikServe’s dashboard with no need to manage and maintain multiple reporting platforms.

QP’s integration with Stripe also increases checkout conversion and improves authorisation rates, so your customers have a positive purchasing experience. If cash flow is an issue, QP’s next day settlements solve the problem by smoothing your deposits and allowing you to cover unexpected expenses.

Safe & Secure

Behind the scenes, QP’s fraud protection services, using Stripe Radar, detects and prevents fraud before it hits your business, with machine learning models trained across hundreds of billions of data points from 195 countries, and in every industry, company size and business model. Radar delivers better accuracy than third-party tools, powered by data gathered from the entire Stripe network, across every layer of the financial stack, and integrated from checkout flows, payments, card networks and banks. Even if a card is new to your business, there’s an 89% chance it’s been seen before on the Stripe network.

2. Evolve Business Models in Changing Market Conditions

Be nimble. Foresight and a focus on the future will help you anticipate and test new revenue opportunities such as order to table, pay at table, online ordering, self-service kiosks, curb-side pickup, gift cards, and even new delivery models – before the market demands it.

Simplified by Technology

The QP platform supports our growing base of existing and new QikServe customers, making it simple and painless to test new revenue models. With our Stripe partnership, QP offers unified online payments.

Don’t waste your time and resources cobbling together disparate components, vendors and legacy systems in your tech stack. Invest in established technology and tap into a single, sophisticated solution that we can integrate and launch quickly and seamlessly, optimising your operations and collecting more revenue in the process.

3. Boldly Enter New Markets

Where many businesses may shy away from the uncertainty and regulatory complexity of international markets, ensure you seek frictionless and future-proof ways to expand globally. Select platforms with the infrastructure to overcome the regulatory and technological barriers unique to your region.

A Localised Approach to Global

To build trust and acceptance in a new market, it’s important to meet your customers where they are. That means not only accepting payment in their local currency but offering your customers’ preferred payment method. Payments are personal and forgoing this step can lead to basket abandonment.

We have partnered with Stripe for QP because we can enable businesses to accept payments in 135+ currencies and the most popular local payment methods, increasing brand loyalty and leading to more successful checkouts.

Payments support adaptiveness – it’s time to recognise that payments are a strategic lever of growth and brand equity. The checkout process is less a transactional afterthought, and more a brand moment – built right into your product strategy. The payments platform you choose says a lot about your brand and can significantly influence your conversion rates and customer experience. In other words, your payments strategy directly affects your bottom line and the overall health of your company.

On the customer side, this means giving your buyers a seamless and simple purchasing experience that understands where they’re coming from and allows them to pay in their preferred way – wherever they are in the world. On the business side, it means having a future-proof, technology-forward business strategy that gives you the flexibility to adapt, stay relevant, and keep growing.

With Stripe, QikServe Payments can help you become more adaptive, increase your revenue, and reach more customers by taking a technology-first approach to managing global payments, with evolving business models and expansion into new markets – all at your fingertips.

All operators are different and there is no one-size-fits-all when it comes to payment platforms. However, finding and investing in the right system for you will lay the groundwork for sustainable growth whilst improving day-to-day operations both for you and your staff, and for the overall guest experience.